Only a yr in the past, Warner Bros. Discovery Channel was using the wave of Barbie popular culture tsunami. In latest days, it is grow to be clear that the pink glow of the field workplace big has lengthy pale.

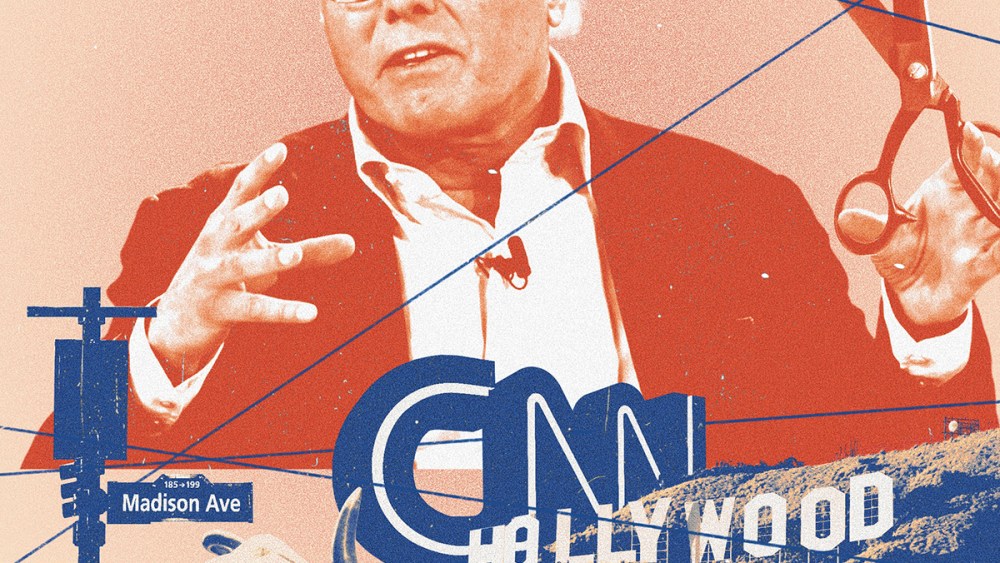

For the reason that starting of the yr, the WBD has been embroiled in a big public combat seemingly of its personal making. It is already engaged in a authorized battle with the NBA. It has continued to take a tough line with Madison Avenue on the pricing of upfront advert gross sales in an period when such techniques are unpopular. Reporters at WBD-affiliated CNN are demoralized. Over the subsequent few months, the corporate is bracing for frosty negotiations with MVPD that may undoubtedly stem the decline in viewers at its cable networks, the potential lack of the NBA, and placing the vast majority of the corporate’s linear programming on Max resolution.

Final week, WBD disclosed that it had written off $9.1 billion within the worth of its cable channel assortment — a stark acknowledgment that the times of annual double-digit will increase in affiliate charges and promoting usually are not coming again.

In a convention name with buyers final week, WBD CEO David Zaslav attributed the decline to “a generational disruption impacting our business,” noting that “even two years in the past, Market valuations and prevailing circumstances for conventional media firms have been additionally very totally different than they’re at this time.

Wall Avenue’s confidence that Zaslav can flip issues round is waning. The corporate’s inventory worth has fallen to an all-time low. There may be additionally rising dialogue surrounding the prospect of splitting up Warner’s belongings.

“We consider the present construction as a consolidated public firm shouldn’t be working,” Jessica Reif Ehrlich, an influential analyst at BofA Securities, wrote in July. “Right now, the construction shouldn’t be working. “We consider exploring WBD’s strategic choices will create extra shareholder worth than the established order,” she added. “All choices should be on the desk.”

With beloved manufacturers like HBO, TNT, CNN, and Warner Bros. taking storms, a administration shakeup is definitely on the horizon, proper?

Mistaken. Zaslav is unlikely to give up anytime quickly. The corporate’s total monetary well being is healthier than it appears to be like, and executives are dedicated to sustaining an investment-grade score. Zaslav and his prime lieutenants have been preserving a detailed eye on WBD’s stability sheet, which is laden with $37 billion in debt from the April 2022 merger of Discovery Communications with AT&T’s WarnerMedia. on the corporate’s shoulders.

Even so, some price cuts have irked key supporters. As Zaslav’s group canceled tasks deemed fringe — together with accomplished films like “Batgirl” and the digital website CNN+ — staff in operations felt that they had been reduce to the bone by higher-ups. WBD’s third spherical of mass layoffs in as a few years started final month when the corporate confirmed plans for 1,000 pink slips.

Zaslav’s total technique is to unite the corporate and climate the storm of streaming disruption whereas constructing the Max platform into a worldwide participant on the size of Netflix and Disney+. That is why he spent plenty of time on the second-quarter convention name speaking in regards to the launch of the Max in Latin American and European markets.

On the identical time, Zaslav’s famously cussed negotiating fashion alienated key contributors to WBD’s money movement: advertisers, sports activities leagues, Hollywood stars and even some reporters working for CNN. Malicious clouds can hurt the long-term well being of an organization whose major asset is its creativity, not the tv community or digital belongings that showcase it.

No marvel members of WBD’s expertise roster look annoyed. Sure, “Contained in the NBA” host Charles Barkley lately signed a brand new contract to stick with TNT Sports activities, however he is been publicly vocal in regards to the firm’s lack of ability to take action after a greater than 30-year relationship with the NBA. Save the NBA’s disappointment, which speaks for itself.

“The problem for organizations is that they begin to assume they’re within the enterprise of managing and manipulating numbers on spreadsheets” relatively than constructing new enterprise by learning the behaviors and pursuits of shoppers and staff, stated company professor Scott Scott D. Anthony stated. “As soon as that occurs, it is principally recreation over.”

Advertisers have complained about WBD’s gross sales techniques for years. Within the latest upfront market, when networks have been attempting to unload a lot of their advert stock, Warner insisted that media shops decide to “development,” which means spending extra {dollars} than that they had dedicated to in 2023 — one thing that is essential given the shrinking cable economic system. A troublesome process.

However two media-buying executives acquainted with latest negotiations stated Warner’s method was notably unrealistic. WBD stated it noticed “robust” upfront commitments in sports activities and development in its streaming enterprise, however didn’t present a selected greenback quantity for total commitments relative to its broader portfolio.

One purchaser stated it is one factor to “beat” a cable TV supplier or sports activities league for a nickel or a dime a few times a decade, but it surely’s utterly totally different to do one thing related each 12 months. One other factor. “I do not assume he understands that it is a totally different kind of negotiation,” the customer stated of Zaslav, echoing the sentiment that advertisers do not prefer to be informed that the hundreds of thousands they’ve spent usually are not passable. perspective.

The chief added that Warner “made it troublesome to speak between a number of layers of individuals.” “I am unable to say I loved coping with Warner Bros.”