The ebook on Paramount International’s months-long merger epic is not but over.

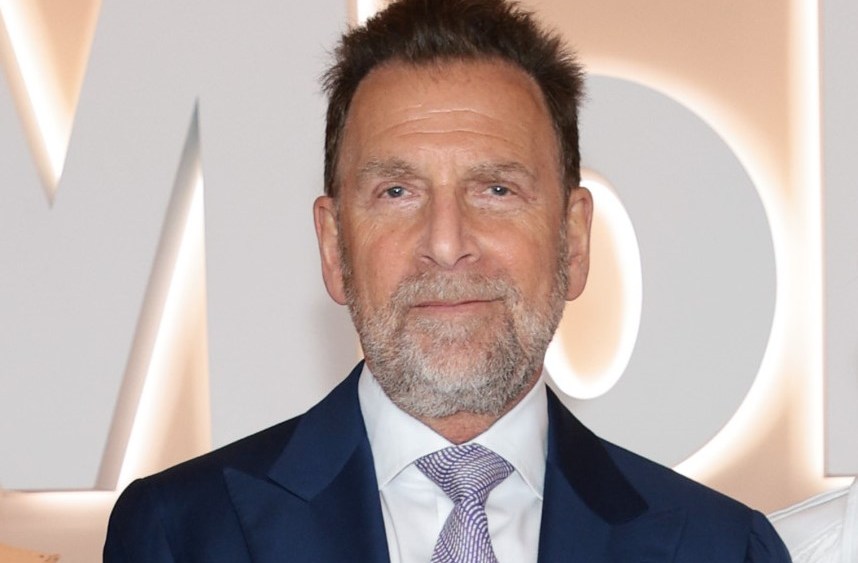

Billionaire media tycoon Edgar Bronfman Jr. submitted a $4.3 billion takeover bid on Monday (August 19) to accumulate Shari Redstone’s Nationwide Amusements Inc., the controlling shareholder of Paramount International, kind Confirmed.

Bronfman’s bid is to compete with a proposal from David Ellison’s Skydance Media and its monetary backers, which final month finalized a deal for NAI and Paramount International A binding settlement value greater than $8 billion, whose property embody CBS, Paramount Footage, Showtime/MTV Leisure Studios and Paramount Footage Ramon Media Community.

Bronfman’s bid has been submitted to a particular committee shaped by Paramount Worldwide’s board of administrators to judge the merger supply, and the committee is predicted to overview it on Wednesday. Representatives for NAI, Bronfman and Skydance declined to remark; representatives for Paramount’s particular committee of the board didn’t reply to requests for remark.

The Wall Avenue Journal first reported Bronfman’s acquisition of NAI.

Bronfman’s supply features a $2.4 billion acquisition of NAI (roughly $1.75 billion after debt); Paramount’s stability sheet specifies an funding of $1.5 billion to repay debt; if Paramount chooses Bronfman’s supply, Paramount Ramon shall be pressured to pay a breakup charge of $400 million to Skydance Group.

On July 7, Paramount Worldwide and Skydance Media introduced a two-part deal that can end in Skydance buying Shari Redstone’s Nationwide Amusements Inc. after which merging with Paramount. Beneath the “go-shop” clause within the settlement, Paramount International has the proper to solicit higher affords inside a 45-day interval, which expires at 11:59 p.m. on August 21.

Bronfman presently serves as govt chairman of Fubo, a streaming pay-TV supplier centered on sports activities, which final week got here to a head as a federal choose issued a Venu lawsuit towards Disney, Warner Bros. Discovery Channel and Fox. Authorized victory for sports activities streaming three way partnership, the corporate has gained a authorized victory. Bronfman served as chairman and CEO of Warner Music Group from 2004-12, resigning after Warner Music Group was acquired by Len Blavatnik’s Entry Industries. Previous to becoming a member of WMG, he served as CEO of Seagram earlier than promoting the enterprise to Vivendi.

With the merger drama nonetheless unresolved, Paramount is making huge layoffs amid falling income from its TV and film companies. The corporate mentioned it might minimize 15% of its U.S. workforce by the tip of 2024, eliminating about 2,000 jobs, as a part of an effort to chop $500 million in annual prices. Chris McCarthy, one of many Paramount associates who heads Showtime/MTV Leisure Studios and Paramount Media Networks, mentioned the layoffs shall be primarily in advertising and marketing and communications, with some in different areas “ sizing,” together with authorized, finance and different company capabilities. International’s three co-CEOs.

Skydance’s cost-cutting targets are much more aggressive. Former NBCUniversal CEO Jeff Shell, who will turn out to be president of Skydance after its merger with Paramount, mentioned Skydance goals to realize no less than $2 billion in annual value synergies for Paramount.